Tax Specialist

ABIC

Job Description

Benefits

Government Mandated Benefits

13th Month Pay, Pag-Ibig Fund, Paid Holidays, Philhealth, SSS/GSIS

Insurance Health & Wellness

HMO

The Tax and Compliance Specialist is responsible for ensuring the company’s and its clients’ full compliance with national and local tax laws and regulations. This role involves the accurate preparation, review, and filing of all tax returns, monitoring deadlines, identifying tax-saving opportunities, and ensuring audit-readiness at all times.

The position also provides expert advice on the tax implications of business decisions, supports audits and assessments, and keeps management informed of any legislative or regulatory changes affecting the company’s tax obligations.

While primarily an individual contributor role, the Tax and Compliance Specialist will work closely with a small tax team (2–3 members), offering technical guidance, coordination, and review support to maintain efficiency, accuracy, and compliance across all tax-related activities.

Duties and Responsibilities:

A. Tax Compliance and Reporting

- Prepare, review, and file monthly, quarterly, and annual tax returns for the company and clients, including but not limited to VAT, Expanded Withholding Tax (EWT/WTE), Final Withholding Tax (FWT), and Income Tax Returns (ITR).

- Ensure the accurate filing and timely payment of all applicable taxes in accordance with schedules such as VAT RELIEF, QAP, SAWT, and other BIR requirements.

- Review and facilitate the prompt issuance of BIR Form 2307 and ensure proper documentation of all tax-related certificates.

- Prepare and submit the annual inventory list and other statutory reports as required by the Bureau of Internal Revenue (BIR).

- Maintain complete, accurate, and organized tax records (both digital and physical) to ensure audit-readiness.

- Collaborate with team members to ensure consistency, accuracy, and timeliness of all filings and reports.

B. Advisory, Audit, and Coordination

- Provide expert guidance to management and internal departments regarding tax treatments and implications of business transactions or decisions.

- Assist in handling BIR audits, assessments, and reconciliations, ensuring timely responses and accurate documentation.

- Coordinate with the Bureau of Internal Revenue (BIR), external auditors, and other government agencies on tax issues, rulings, and audits.

- Support and participate in tax-related special projects or assessments as assigned.

- Stay updated on new or changing tax laws and regulations, analyze their impact, and recommend appropriate process adjustments or compliance measures.

C. Financial Review and Process Improvement

- Review and analyze financial statements and reports to ensure tax accuracy and compliance with applicable laws.

- Conduct research and analysis on tax-related issues to support decision-making and minimize tax risks.

- Identify tax-saving opportunities and support tax planning initiatives in compliance with legal standards.

- Work with the accounting manager and team members to develop and enhance internal controls, documentation systems, and overall efficiency of the tax process.

- Provide guidance and knowledge-sharing to less-experienced team members to strengthen the overall tax function.

- Perform other related duties as may be assigned to support tax and compliance objectives.

Ashley Boquiren

HR OfficerABIC

Reply 1 Time Today

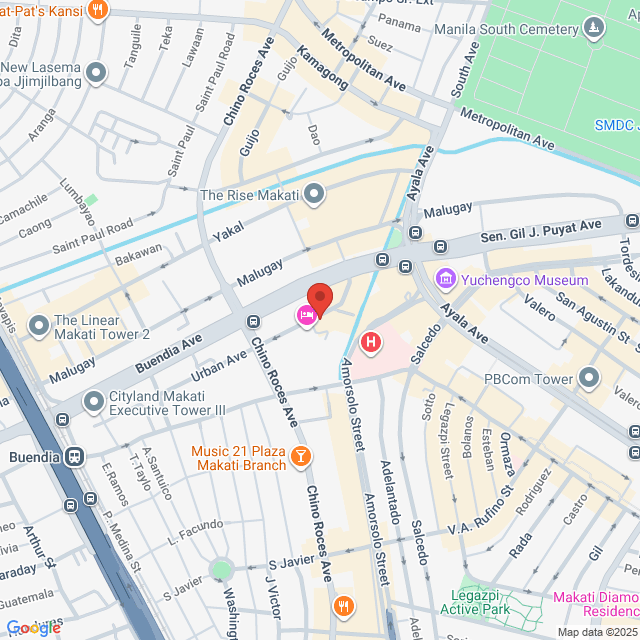

Working Location

Unit 402, Campos Rueda Building. unit 202, campos rueda building, 101 Urban Ave, Makati City, 1206 Metro Manila, Philippines

Posted on 29 October 2025

Explore similar jobs

View more similar jobsTax Specialist

RCGI

RCGI₦489.5-538.4K[Monthly]

On-site - Makati1-3 Yrs ExpBachelorFull-time

Rochelle MagsinoTalent Acquisition Officer

Australian Tax Consultant

Risewave Consulting Inc.

Risewave Consulting Inc.₦1.5-2M[Monthly]

On-site - Makati1-3 Yrs ExpBachelorFull-time

Gianne NunezRecruiter

Tax and Bookkeeping Associate

Starlight Business Consulting Services, Inc.

Starlight Business Consulting Services, Inc.₦611.8-734.2K[Monthly]

On-site - Makati1-3 Yrs ExpBachelorFull-time

Joy de BelenHR Officer

Tax Specialist

ABIC Manpower Service Corp.

ABIC Manpower Service Corp.₦489.5-611.8K[Monthly]

On-site - Makati1-3 Yrs ExpBachelorFull-time

ABIC Manpower Service CorpHuman Resources & Recruitment

Tax Analyst

Solenergy Systems Inc.

Solenergy Systems Inc.₦611.8-856.6K[Monthly]

On-site - Makati1-3 Yrs ExpBachelorFull-time

Joanna CacayanHR Officer

ABIC

Unfinanced / Angel

<50 Employees

Business Service

View jobs hiring

Sign In to Chat with Boss

Bossjob Safety Reminder

If the position requires you to work overseas, please be vigilant and beware of fraud.

If you encounter an employer who has the following actions during your job search, please report it immediately

- withholds your ID,

- requires you to provide a guarantee or collects property,

- forces you to invest or raise funds,

- collects illicit benefits,

- or other illegal situations.